If you’re entering the realm of Mixed Martial Arts as a fighter, coach, or entrepreneur, MMA insurance is vital to your well-being and security.

You may think that skill and training would suffice, but one unexpected accident or liability suit would overturn your world more than once. MMA insurance isn’t an insurance policy — it’s your protection from outrageous medical expenses, lawsuits, and career interruption.

From keeping you fit to assisting in securing the future of your gym, this guide takes you through all of it. Prepare to discover how to fight smarter outside the cage by fighting for what counts most, because in MMA, preparation is not merely about preparing for the fight.

1. Purpose of MMA Insurance

When you purchase MMA insurance, you’re covering yourself, your gym, or your event against the special risks of mixed martial arts. The coverage is designed to address the bodily risks of training and competing, in which injuries are prevalent because of the intense nature of the sport.

Whether you are a fighter entering the cage, a gym owner with daily training sessions, or a promoter holding fights, mixed martial arts insurance protects you in case of loss of money should an accident or injury occur. Without this type of coverage to fall back on as protection, you might end up paying costly medical expenses or lawyers’ fees when something goes awry.

Essentially, MMA insurance is a safeguard, so you can be able to focus on your performance or event planning with confidence, knowing that you are protected from the uncertainties of risk in the sport. It is a critical component of being safe and secure in MMA.

2. Types of Coverage

While researching MMA insurance, you have to know the kinds of coverage available to you. Your coverage will generally consist of medical coverage, which will pay for any injuries that you could receive in training or in fighting—anything from a visit to the emergency room to surgery and rehab.

Liability insurance is also necessary, as it will cover you in case your actions hurt another person, whether you are a fighter, gym owner, or event promoter. If you are promoting a fight, event cancellation insurance will bail you out in case your fight is canceled because of something outside of your control, such as bad weather or problems with the venue.

Certain policies even cover your equipment, so you won’t need to pay for it personally if it gets stolen or lost. Knowing these kinds of coverages makes you acquire a policy that meets your specific needs in the MMA field.

3. Medical and Injury Protection

As an MMA member, you are aware of how physically stringent and demanding the sport is. An injury is most likely to occur, which is why medical and injury protection through MMA insurance matters greatly to you.

Medical MMA insurance will pay for your medical expenses should you sustain an injury either while you are at training or while fighting—whether a broken bone, a concussion, or worse, injuries that will need surgery and rehabilitation. In not covering this, you may be compelled to spend enormous out-of-pocket charges that are economically draining.

In addition, certain policies even cover coverage towards paying compensatory non-working income, which you may lose when you can no longer work due to recovering from an injury. With this type of coverage, you can more strongly concentrate on your training and performance while knowing that in case something unexpected occurs, you won’t have the cost implications of injuries.

4. Liability Protection

When you are operating a gym or selling MMA events, you cannot risk not having liability protection. Liability insurance is to guard against your being held liable if someone gets hurt or injured due to something that happened in your jurisdiction.

For instance, if a fighter or even one of the spectators is injured during training sessions or at your event, you could find yourself legally held responsible. Without liability insurance, you might find yourself paying medical bills, attorney fees, or even settlements out of your own pocket, which can prove to be financially devastating.

With liability insurance, you’re covered if there’s an accident or a negligence claim against you, allowing you to concentrate on growing your gym or putting on successful events. It is an essential part of mitigating the risks associated with the MMA arena and ensuring your business remains secure.

5. Policy Requirements and Costs

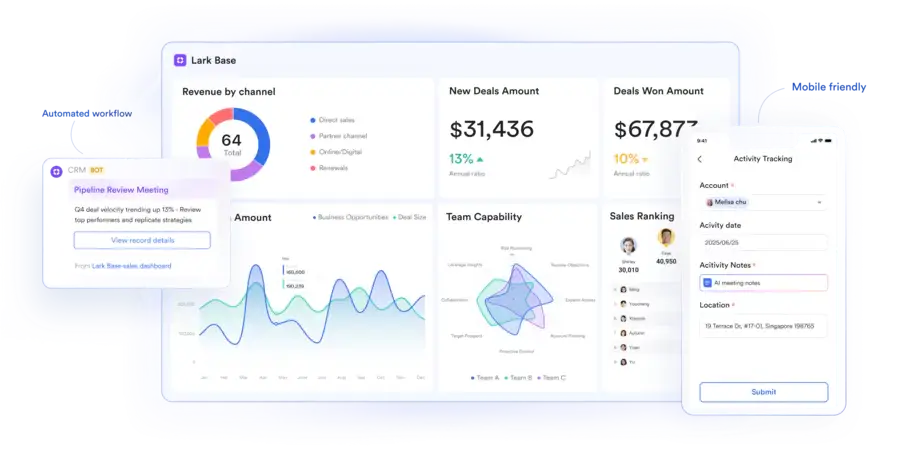

Before choosing MMA insurance, it’s important to understand that policies and costs can vary widely based on several factors. Your premium will depend on things like your experience level as a fighter, the size and frequency of the events you’re involved in, and the location where you train or compete.

If you’re a promoter or gym owner, the number of participants and the level of risk involved will also affect your coverage costs. Some MMA organizations even require you to carry specific types of insurance before you can participate in their sanctioned events, so you’ll want to make sure you meet those requirements.

By carefully selecting the right policy for your needs and budget, you can avoid surprises and ensure you have the right protection in place, letting you focus on your training, events, or business with confidence.

Conclusion

Now that you know the essentials of MMA insurance, you’re better equipped to protect yourself, your gym, or your event from the unpredictable risks that come with the sport.

Whether it’s covering medical bills, shielding against liability claims, or safeguarding your event investments, having the right insurance gives you the freedom to focus on what matters most—training hard, competing safely, and growing your MMA passion.

Don’t leave your future to chance; getting the right coverage ensures you’re prepared for whatever the cage throws your way. Stay smart, stay protected, and keep fighting with confidence.