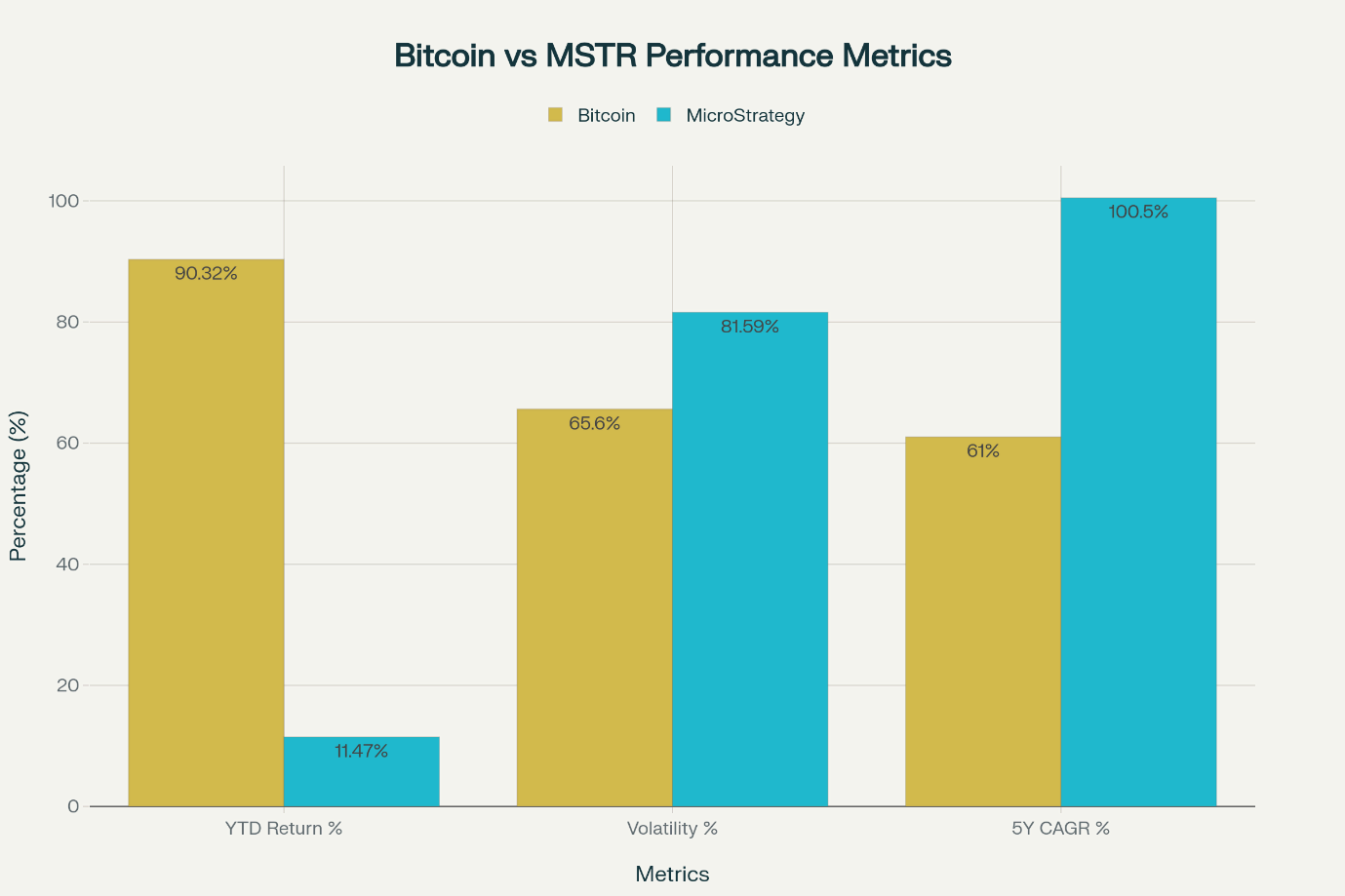

A $10,000 investment in MicroStrategy five years ago would be worth $324,290 today—more than triple the $102,229 from the same Bitcoin investment. This staggering 2,758% return versus Bitcoin’s 956% gain reveals the power of leveraged crypto exposure through corporate proxies. However, Bitcoin’s commanding 90% year-to-date performance in 2025 compared to MSTR’s modest 11% gain demonstrates why choosing between direct digital asset ownership and proxy investments requires sophisticated analysis of risk, timing, and investment objectives.

MicroStrategy’s Superior Long-Term Performance Through Financial Engineering

MicroStrategy’s (NASDAQ: MSTR) extraordinary outperformance stems from a meticulously executed leveraged Bitcoin strategy that transformed a struggling software company into the world’s largest corporate cryptocurrency holder. Trading at $334.41 with a $94.6 billion market capitalization, MSTR has achieved a remarkable 100.5% compound annual growth rate over five years.

Bitcoin vs MicroStrategy: Key Performance and Risk Metrics Comparison

The company’s strategic advantages include:

Leverage Amplification: With 628,791 bitcoins worth approximately $63 billion—representing 3% of total Bitcoin supply—MicroStrategy provides amplified exposure to Bitcoin price movements. Each 10% Bitcoin increase generates magnified returns through the company’s concentrated treasury strategy.

Dual Revenue Streams: Unlike pure Bitcoin ownership, MicroStrategy generates $114.5 million quarterly revenue from its core business intelligence operations, providing operational cash flow that supports its crypto acquisition strategy.

Capital Market Access: The company has successfully raised $17.3 billion in long-term debt while maintaining a conservative debt-to-equity ratio of 0.16, demonstrating sophisticated capital allocation that funds Bitcoin purchases without excessive financial risk.

Average Cost Advantage: With an average Bitcoin cost basis of $73,277, MicroStrategy sits on substantial unrealized gains at current Bitcoin prices of $109,162.70, providing a built-in margin of safety for investors.

Bitcoin’s Direct Ownership Benefits in 2025

Bitcoin’s impressive 90.32% year-to-date return, pushing its market capitalization to $2.09 trillion, underscores the digital asset’s fundamental strength. Direct Bitcoin ownership offers several compelling advantages:

Pure Price Exposure: Bitcoin provides 100% correlation to cryptocurrency price movements without corporate governance risks, management decisions, or financial engineering complexities that could dilute returns.

Lower Volatility Profile: At 65.6% annualized volatility versus MSTR’s 81.59%, Bitcoin offers more manageable risk characteristics for portfolio construction, making it suitable for broader investor bases.

Regulatory Clarity: Bitcoin ETFs like BlackRock’s iShares Bitcoin Trust (IBIT) have achieved institutional acceptance, providing clear regulatory pathways without the complexity of equity analysis required for MicroStrategy evaluation.

No Counterparty Risk: Direct ownership eliminates exposure to corporate bankruptcy, management missteps, or leverage decisions that could amplify losses during market downturns.

Risk-Adjusted Analysis: The Volatility-Return Trade-off

While MicroStrategy delivers superior absolute returns, investors must consider the risk-adjusted implications. MSTR’s maximum drawdown of -81.1% during crypto bear markets significantly exceeds Bitcoin’s typical corrections, reflecting the amplified downside risk of leveraged exposure.

However, sophisticated risk analysis reveals MicroStrategy maintains a superior Sharpe ratio despite higher volatility, indicating better risk-adjusted returns over the measurement period. This suggests the company’s leverage strategy operates within acceptable risk parameters for aggressive growth investors.

Key Risk Considerations:

- Equity Dilution:MicroStrategy issued over 20 million shares in 2025 through various offerings, creating 15% ownership dilution for existing shareholders

- Forced Selling Risk:Preferred stock obligations requiring $9.6 billion annually in dividends could force Bitcoin liquidation during market stress

- Leverage Sensitivity:If Bitcoin drops to $70,000, debt-to-equity ratios would deteriorate to approximately 0.25, constraining future capital allocation flexibility

Institutional Investment Dynamics and Market Outlook

The institutional landscape heavily influences both investments, with 59% of institutional investors planning to allocate over 5% of assets under management to digital assets in 2025. MicroStrategy’s pending S&P 500 inclusion decision on September 5, 2025, represents a potential catalyst for massive institutional inflows.

Expert Price Projections:

- Cathie Wood (Ark Invest):$1 million Bitcoin based on finite supply dynamics

- Anthony Scaramucci:$170,000 within 12 months driven by institutional adoption

- Michael Saylor:Supply shocks following Bitcoin’s recent halving event

These bullish scenarios particularly benefit MicroStrategy due to its leveraged exposure structure. The company’s Q2 2025 results showing $14 billion operating income and $10 billion net income demonstrate how Bitcoin appreciation translates directly to corporate earnings.

Strategic Investment Framework for Different Investor Profiles

Conservative Investors: Bitcoin direct ownership or Bitcoin ETFs provide optimal risk-adjusted exposure. The lower 65.6% volatility enables portfolio integration without excessive risk concentration, while maintaining pure cryptocurrency beta.

Aggressive Growth Investors: MicroStrategy offers superior wealth creation potential through proven financial engineering. The 2,758% five-year return demonstrates the power of leverage when executed by experienced management teams with deep cryptocurrency expertise.

Institutional Investors: Portfolio diversification across both assets optimizes risk-return profiles. Bitcoin provides foundational crypto exposure, while MSTR offers traditional equity wrapper benefits with amplified cryptocurrency sensitivity.

Hedge Funds and Family Offices: Sophisticated investors can employ both assets tactically, using Bitcoin for core positions and MicroStrategy for leveraged exposure during favorable market conditions.

Future Market Implications and Strategic Considerations

The 2025 cryptocurrency landscape presents unprecedented institutional adoption momentum. With 84% of institutions exploring stablecoin usage and major corporations following MicroStrategy’s treasury strategy, both investments benefit from expanding market acceptance.

Critical Success Factors:

- Regulatory Evolution:Continued Bitcoin ETF approvals and cryptocurrency regulation clarity

- Institutional Adoption:Corporate treasury adoption following MicroStrategy’s blueprint

- Market Infrastructure:Improved cryptocurrency custody and trading solutions

- Macroeconomic Conditions:Interest rate environments affecting leverage strategies

Investment Decision Framework

The choice between Bitcoin and MicroStrategy requires alignment with specific investment objectives:

Choose Bitcoin When:

- Seeking pure cryptocurrency exposure without corporate risk

- Prioritizing lower volatility and drawdown characteristics

- Requiring regulatory clarity for institutional mandates

- Implementing core cryptocurrency allocations

Choose MicroStrategy When:

- Targeting maximum wealth creation through leverage

- Comfortable with higher volatility and corporate risks

- Seeking traditional equity wrapper for crypto exposure

- Believing in management’s strategic execution capability

Frequently Asked Questions

Q: Why has MicroStrategy outperformed Bitcoin historically? A: MicroStrategy’s leveraged exposure through debt financing and concentrated Bitcoin holdings amplifies price movements. Every Bitcoin increase generates magnified returns through the company’s 628,791 BTC treasury position.

Q: What are the main risks of investing in MicroStrategy versus Bitcoin? A: MSTR carries corporate governance risks, leverage concerns, equity dilution, and potential forced selling during market stress. Bitcoin offers pure exposure without these corporate complexities.

Q: How does institutional adoption affect both investments? A: Institutional adoption benefits both assets, with Bitcoin gaining from direct allocations and ETF flows, while MicroStrategy benefits from S&P 500 inclusion and corporate treasury trend adoption.

Q: Which investment offers better tax efficiency? A: Tax implications vary by jurisdiction and holding structure. Bitcoin may offer advantages in some tax-advantaged accounts, while MicroStrategy provides traditional equity tax treatment.

Q: How do market cycles affect the Bitcoin vs MicroStrategy comparison? A: During bull markets, MicroStrategy’s leverage amplifies gains. During bear markets, MSTR typically experiences larger drawdowns due to leverage effects and corporate risk premiums.

Q: What role does management play in MicroStrategy’s performance? A: CEO Michael Saylor’s cryptocurrency expertise and strategic vision drive the company’s treasury strategy. Management quality significantly impacts execution of the leveraged Bitcoin approach.

Q: Should investors choose one or diversify between both? A: Sophisticated investors often employ both: Bitcoin for core crypto exposure and MicroStrategy for leveraged upside participation, optimizing risk-return characteristics across market cycles.

The Bitcoin versus MicroStrategy decision ultimately reflects investor risk tolerance, return objectives, and market timing considerations. MicroStrategy’s proven 2,758% five-year outperformance makes a compelling case for leveraged crypto exposure, while Bitcoin’s 90% year-to-date gain in 2025 demonstrates the digital asset’s fundamental strength.

As institutional adoption accelerates and cryptocurrency markets mature, both investments offer distinct advantages within sophisticated portfolio construction strategies. The key lies in matching investment choice to individual risk capacity and return requirements in this rapidly evolving digital asset landscape.

How does your organization’s risk tolerance align with these investment options? What role should leveraged cryptocurrency exposure play in institutional portfolio allocation strategies?