Key Takeaways

- Explore various income-boosting opportunities to alleviate financial strain.

- Implement budgeting techniques to control and reduce expenses.

- Utilize community resources and assistance programs for immediate support.

- Consider alternative financing options with caution and informed decision-making.

Table of Contents

- Introduction

- Income-Boosting Strategies

- Effective Budgeting Techniques

- Leveraging Community Resources

- Exploring Alternative Financing Options

- Practicing Mindful Spending

- Building an Emergency Fund

- Seeking Professional Financial Advice

- Maintaining Financial Health Long-Term

Introduction

Facing sudden expenses or shortfalls in income doesn’t have to derail your long-term financial plans. With a blend of creativity, resourcefulness, and technology, you can find ways to ease short-term financial pressure and position yourself for lasting stability. Whether you explore new income opportunities, leverage digital tools, or consider community aid, a proactive approach helps weather difficult times. For insight on user experiences with flexible lending options, see MaxLend Reviews to understand alternative financing perspectives in real-life contexts better.

Using innovative strategies tailored to your situation allows you to manage temporary money setbacks while preventing a cycle of debt and stress. Proactively tackling challenges now supports your overall financial health and increases confidence, even when the future seems uncertain.

Income-Boosting Strategies

When you need cash fast, more opportunities exist than ever to supplement your income. Taking quick gig jobs through apps like Instacart, DoorDash, or TaskRabbit lets you work flexibly and earn on your own schedule. For those with marketable skills, freelancing sites such as Upwork and Fiverr offer ways to pick up short projects, from writing to graphic design. Selling possessions on Facebook Marketplace, Craigslist, or eBay can provide instant liquidity while decluttering your home. Consider renting a spare room with Airbnb or hosting paid experiences to utilize unused space and skills for extra earnings.

Effective Budgeting Techniques

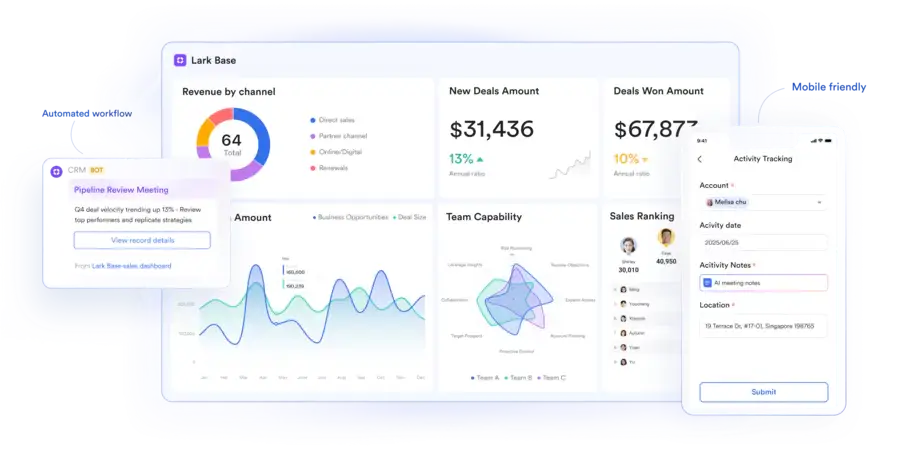

Budgeting helps you stretch available resources and prioritize essentials. Use digital tools like Mint, YNAB (You Need A Budget), or EveryDollar to monitor spending closely and spot patterns or leaks. The 50/30/20 rule offers a straightforward approach—allocating 50% of income for needs, 30% for wants, and 20% for savings. Start by listing all expenses and trimming non-essentials such as streaming subscriptions, frequent take-out, or luxury services. Consider implementing envelope budgeting for categories where you tend to overspend, physically or digitally assigning cash limits that cannot be exceeded.

Leveraging Community Resources

Your community can be a vital safety net in tough times. Food banks provide groceries to bridge gaps, and many local organizations offer rent, utility, or medical bill support. Sites like 211.org connect you with local services tailored to individual needs, including childcare, housing, and employment counseling. Non-profits such as the United Way have programs to help with basic needs, while libraries may offer job search assistance, internet access, and free financial workshops. Reaching out to these organizations can provide immediate relief and peace of mind.

Exploring Alternative Financing Options

If you need funds that personal savings or community resources can’t cover, alternative finance may be worth considering cautiously. Peer-to-peer lending platforms like LendingClub match borrowers with individual investors, sometimes offering more accommodating terms than traditional banks. Credit unions may grant small-dollar loans with lower interest and friendlier policies than large banks. Always review terms carefully, factor in fees or penalties, and avoid predatory lenders. Securing a loan should be a last resort after exhausting other avenues.

Practicing Mindful Spending

Impulse purchases can quickly derail your budget, especially when emotions run high in a financial emergency. To curb emotional spending, adopt a “cooling-off” period—wait 24 to 48 hours before buying non-essentials. Ask yourself whether the purchase meets a true need or merely satisfies a temporary want. Using cash instead of cards for discretionary expenses can also prevent overspending. Taking the time to meal-plan before grocery shopping or making coffee at home instead of buying out are simple habit shifts that add up.

Building an Emergency Fund

Savings, even if modest, give you a critical advantage during financial shocks. Start small if needed—setting aside $10–$25 per paycheck builds momentum and creates a feeling of security. Micro-saving apps such as Acorns round up everyday purchases and invest the difference, helping you grow a cushion effortlessly over time. Over several months, work toward saving three to six months’ worth of living expenses. If that goal feels daunting, celebrate every milestone and stay consistent; the foundation you lay now can prevent crises later.

Seeking Professional Financial Advice

Professional guidance can provide game-changing support during times of uncertainty. Certified financial counselors, available through non-profits like the National Foundation for Credit Counseling (NFCC), offer free or low-cost advice on debt management, budgeting, and navigating major life changes. Even a single consultation may clarify your options, outline practical steps, and relieve some of the anxiety tied to financial uncertainty. Look for advisors with fiduciary duty who put your interests first.

Maintaining Financial Health Long-Term

Building resilience goes far beyond a temporary fix. Routinely revisiting your budget, automating savings, and increasing financial literacy set the foundation for lasting success. Seek out personal finance books, workshops, or podcasts tailored to your learning style; sites like Consumer Financial Protection Bureau provide reliable tools for continuous learning. Set specific, achievable goals—such as paying off a credit card or growing your emergency fund by a certain date—and celebrate your achievements along the way. Even after the immediate crisis passes, maintaining these habits creates a buffer for whatever comes next and puts you on the path to true financial security.