The crypto market is a beast without borders or bedtime. It runs 24/7, 365—fueled by code, caffeine, and a curious mix of math and myth. If you’ve ever stared at a chart at 3 a.m., wondering if that dip is a trap or a ticket to the moon, you’re not alone. It’s a wild ride. And somewhere along the way, you’ll hear about trading bots: software that trades for you. No sleep, no hesitation, just rules and execution. The pitch? More gains, less grind. But is the promise as clean as the pitch?

Trading bots do exactly what they’re told—automated buys and sells based on strategies ranging from basic (buy low, sell high) to complex (arbitrage, grid trading, scalping). They’re the hired guns of crypto: tireless, emotionless, and fast. But not flawless. To really understand their value, you’ve got to zoom out. Look at something like the Solana price history—a chart shaped by surges, stalls, and sentiment. Bots don’t read that story. They read momentum. Volume. Volatility. They don’t anticipate; they react. And that difference matters, because crypto isn’t just math—it’s mood.

The Allure of Automation

You’re busy. You’ve got a job, maybe a side hustle, and now you’re learning how blockchain works while trying not to fall for another hype coin. The idea of a trading bot swooping in and doing the heavy lifting is hard to ignore. Set your strategy, walk away, come back to profits. That’s the dream.

And sometimes it works. Bots don’t get scared. They don’t revenge trade. They don’t go “all in” because of a tweet. In theory, they’re ideal. But in practice, they’re only as smart as the rules you give them—or the person who coded them.

Most beginners start with “plug-and-play” bots that follow pre-built strategies. These can work in stable, trending markets. But crypto isn’t always stable. It’s a storm system. What works today might blow up tomorrow. A bot optimized for a bull run can get wrecked in a sideways churn. A scalping strategy tuned for low fees might bleed out during network congestion. In short: you still need to know what you’re doing.

Trading Bots Aren’t Magic

Let’s be clear: bots don’t beat the market. They just play it differently. They don’t predict the future. They respond to triggers. Crosses, breakouts, Fibonacci levels—whatever script you feed them. If the market behaves, bots can shine. If not, they follow orders into the abyss.

And then there’s latency. That’s the delay between a bot’s decision and execution. In crypto, milliseconds matter. A fast-moving token can moon or crash in the time it takes your bot to hit “confirm.” Slippage—when you get a worse price than expected—is a constant risk. Bots aren’t immune to it. In fact, they often exacerbate it.

Another truth: bots can overtrade. Set too many triggers, and your account becomes a blur of fees and friction. It’s easy to burn through capital chasing micro-movements that don’t add up. Automation without discipline is just chaos in fast-forward.

Business Logic and Bot Behavior

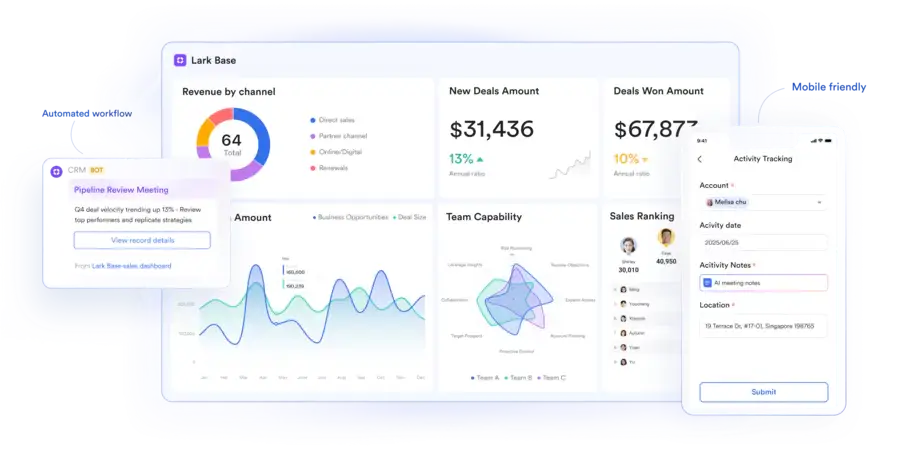

Crypto bots, when used well, mimic business logic. That is: they operate with structured rules, like a small business that opens on time, tracks expenses, and follows a budget. A bot is not a casino bet. It’s a set of repeatable actions. You define the mission. The bot executes.

But like any business, it needs oversight. Strategies change. Market regimes shift. Tokens die. No bot should run on autopilot forever. Think of it as a co-pilot, not a captain. You still need to check the map. And when things go sideways (and they will), you need to know how to override.

In that sense, bots are not fire-and-forget weapons. They’re tools in a toolkit. Helpful, but not holy. The best traders don’t use them to escape responsibility. They use them to enhance consistency.

The AI Temptation

Lately, there’s been a rise in buzzwords—“AI-powered,” “deep learning,” “neural net.” Sounds impressive. Feels futuristic. But here’s the catch: most so-called AI bots in crypto aren’t truly intelligent. They’re glorified pattern-matchers, often trained on outdated or irrelevant data.

Real AI in trading is still a frontier. It requires robust data, clean feedback loops, and a lot of capital. If you’re hearing promises of guaranteed returns from an AI bot, be skeptical. Very skeptical. A well-trained AI can spot signals—but it can’t eliminate risk. No one has figured out how to code clairvoyance.

So, Are They Worth It?

Here’s the truth in plain terms:

Pros:

- Bots are consistent. They don’t panic or sleep.

- They can execute fast, high-frequency strategies that humans can’t.

- With proper configuration, they can remove emotion from your trades.

Cons:

- Most bots need active management and tweaking.

- They can misfire in volatile or choppy markets.

- Slippage, fees, and poor strategy design can eat away profits.

- They don’t protect you from bad setups—only you can do that.

Know Thy Bot

Crypto is not just about technology. It’s about timing, temperament, and tenacity. A bot won’t make you rich. It won’t solve your problems. But used wisely, it can be a powerful assistant in your trading stack.

Start slow. Understand your strategy. Backtest before you deploy. And always remember: automation is not a shortcut to success—it’s a multiplier of skill. If you’re a disciplined trader, bots can sharpen your edge. If you’re not, they’ll just automate your mistakes.

This space rewards curiosity and punishes complacency. Stay sharp. Stay skeptical. And when in doubt, trust your instincts over the interface.