Financial security doesn’t just happen. It’s built through a series of intentional habits, and one of the most important is smart bank account management. For many people, managing money feels overwhelming. But when you break it down into actionable steps—like how you use your bank accounts—you can gain more control over your financial future.

Let’s explore how wisely handling your bank accounts can pave the way toward lasting financial stability.

Why Bank Account Management Matters

Think of your bank accounts as the foundation of your financial house. If that foundation is disorganized or weak, the entire structure becomes unstable. Poor bank account management often leads to missed payments, unnecessary fees, and trouble tracking where your money goes. That kind of chaos adds stress and can make it harder to achieve long-term goals like buying a home, investing, or retiring comfortably.

On the other hand, organized banking habits give you clarity. You can see what’s coming in, what’s going out, and where your money is best put to use. It’s a simple shift in behavior with powerful results.

Separate Accounts, Clear Purpose

The first step to smarter management is account separation. Instead of lumping all your money into one checking account, consider setting up different accounts with specific purposes. For example:

- A primary checking account for paying bills and everyday spending.

- A dedicated savings account for emergency funds or big purchases.

- A long-term savings or investment account for retirement or future plans.

This kind of setup not only keeps your funds organized but also reduces the temptation to overspend. When money is clearly designated, it’s easier to respect boundaries and stay disciplined.

Track, Don’t Guess

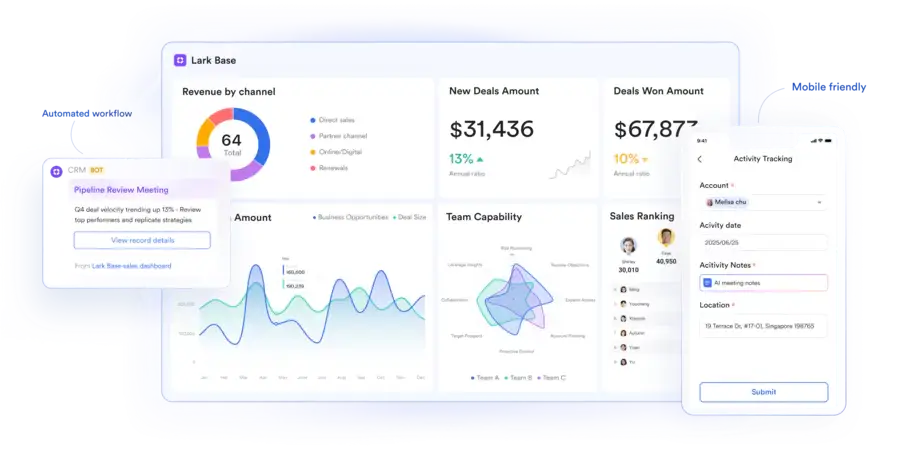

Many people rely on mental math to figure out if they can afford something. That’s risky. Monitoring your bank accounts regularly—through banking apps or personal finance tools—helps you spot patterns and correct issues early.

Tracking allows you to:

- Avoid overdraft fees.

- See where small expenses add up.

- Adjust your budget as income or goals change.

According to the Consumer Financial Protection Bureau, consistent tracking and using account alerts can significantly reduce financial stress. In short, guessing is gambling. Tracking is strategy.

Automate with Purpose

Automation is one of the best tools for financial stability. By setting up automatic transfers and payments, you ensure that your obligations are met without fail. It also helps with savings. You’re more likely to build a safety net if money is transferred into savings automatically after payday.

Consider automating:

- Utility and loan payments

- Transfers to savings

- Credit card minimums to avoid late fees

The trick is to stay aware of what’s being automated. Automation doesn’t replace management—it supports it.

Plan for the Unexpected

A major part of financial stability is preparing for the things you can’t predict—job loss, medical emergencies, or sudden repairs. That’s where an emergency fund comes in.

You might wonder, how much should an emergency fund be? Financial experts recommend saving enough to cover three to six months of essential expenses. This might sound like a lot, but by setting up a separate savings account and contributing to it regularly, the fund will grow over time.

An emergency fund isn’t just a cushion. It’s a safety net that lets you face tough situations without taking on high-interest debt or raiding your long-term savings.

Reduce Risk of Identity Theft and Fraud

A neglected bank account is an easy target for fraudsters. Monitoring your accounts regularly protects you against unauthorized transactions and identity theft. Set up notifications for large transactions, logins, and transfers. Check your statements monthly for anything unfamiliar.

If you rarely log into your account, you may not notice suspicious activity until it’s too late. Smart management means staying engaged and responding quickly if something looks off.

Use Your Bank’s Tools

Most modern banks offer a wide range of digital tools and financial insights. From spending summaries to savings goals, these features help you understand your habits better. Use them.

Set budget alerts. Enable notifications. Analyze where your money goes each month.

Taking advantage of these features doesn’t cost anything extra—but they can lead to big improvements in how you manage your finances.

Make Periodic Account Reviews a Habit

Bank account management isn’t a one-and-done task. Life changes. Expenses shift. Incomes rise and fall. That’s why it’s important to review your accounts and financial strategy every few months.

During these check-ins, ask yourself:

- Are you being charged hidden fees?

- Can you negotiate better rates?

- Is your savings plan still aligned with your goals?

- Do you need to close or open any accounts?

A short review can prevent long-term problems and help you course-correct as needed.

Final Thoughts: It’s About Control, Not Complexity

Managing your bank accounts wisely isn’t about being perfect. It’s about being intentional. It’s about building habits that support the life you want, not just today, but for years to come.

The good news is that it doesn’t take expert-level knowledge to do this well. Just a few consistent practices—like separating accounts, tracking spending, and planning for the unexpected—can make a massive difference in your financial outlook.

In the end, wise bank account management gives you more than numbers in the black. It gives you peace of mind, better decision-making power, and a strong path toward a secure financial future.