For years, financial institutions viewed cloud computing with skepticism when milliseconds determined profit margins. The perceived latency disadvantages kept algorithmic trading firmly rooted in physical data centers, where proximity to exchanges promised unbeatable execution speeds. Yet recent technological breakthroughs have shattered these assumptions, with cloud infrastructure now achieving performance metrics that rival traditional colocation setups.

Specialized managed cloud service providers have pioneered innovations that address the unique demands of electronic trading. By leveraging cutting-edge network optimizations and custom hardware acceleration, they’ve reduced round-trip times to levels that satisfy even the most latency-sensitive strategies. This evolution forces trading firms to reconsider long-held infrastructure beliefs.

The Physics of Speed Reimagined

Light travels through fiber optic cables at roughly two-thirds the speed of light in vacuum – an immutable physical constraint. However, next-generation cloud architectures minimize latency through intelligent routing that reduces overall distance traveled. Instead of focusing solely on the last mile to exchanges, engineers now optimize the entire data path from trading algorithms to execution systems.

Hardware Breakthroughs Level the Playing Field

Custom silicon accelerators handle market data processing more efficiently than general-purpose CPUs. Smart network interface cards bypass operating system stacks to shave off precious microseconds. Cloud providers now offer bare-metal instances with kernel-bypass networking, eliminating virtualization overhead that previously hindered performance. These innovations collectively close the gap with physical infrastructure.

Network Topology Gets Smarter

Traditional latency measurements focused exclusively on proximity to exchange gateways. Modern cloud solutions employ dynamic routing algorithms that continuously assess network congestion. During peak trading periods, these systems can sometimes outperform static colocation setups by avoiding overloaded network segments through alternative pathways.

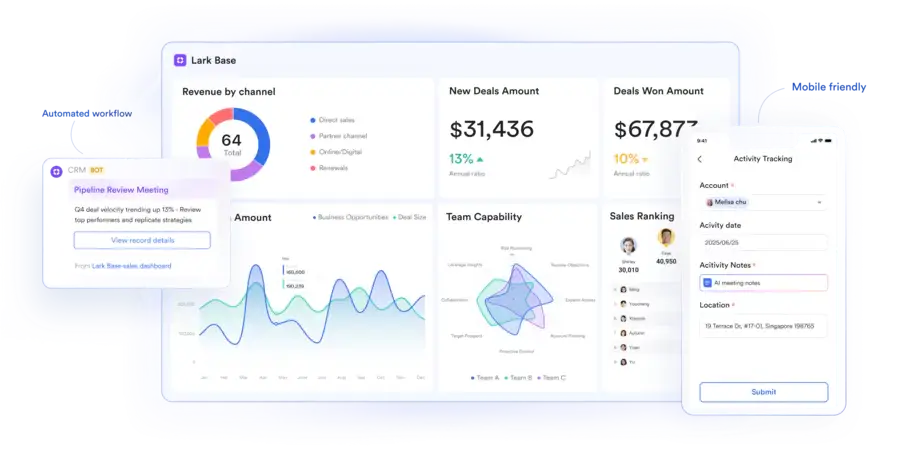

The Cost-Performance Equation Shifts

Colocation demands massive capital expenditures for rackspace and dedicated hardware. Cloud trading infrastructure operates on flexible consumption models, allowing firms to scale resources precisely when needed. This financial democratization enables smaller players to compete without prohibitive upfront investments while maintaining enterprise-grade performance.

Regulatory Barriers Crumble

Exchanges that once mandated physical presence now certify cloud-based trading memberships. Compliance teams increasingly prefer the detailed audit trails and security controls available through virtualized environments. These shifts remove institutional roadblocks that previously hindered cloud adoption for regulated trading activities.

Real-World Performance Metrics

Independent benchmarks reveal cloud-based trading systems achieving 90-95% of colocation speeds for most strategy types. While ultra-high-frequency trading may still require physical proximity, execution algorithms and statistical arbitrage strategies often find cloud performance more than sufficient – especially when considering the added benefits of global deployment capabilities.

Hybrid Architectures Emerge

Forward-looking firms blend both approaches strategically. Core latency-sensitive components might remain colocated, while other elements leverage cloud elasticity. This balanced methodology provides optimal flexibility – maintaining physical infrastructure where it matters most while gaining cloud advantages elsewhere.

The Verdict on Cloud Latency

The myth of inherent cloud inferiority for low-latency trading has been conclusively dispelled. While not every trading scenario suits virtualized infrastructure, the performance differential has narrowed to the point where strategic considerations outweigh raw speed metrics. As cloud providers continue innovating while physical data centers remain constrained by fundamental limitations, this convergence will only accelerate.

Trading firms now face infrastructure decisions based on total workflow efficiency rather than outdated latency dogmas. The cloud’s combination of competitive speeds, global scalability, and financial flexibility represents the future of electronic trading – a future already unfolding across capital markets worldwide.