Running a medical practice means juggling a lot of moving parts. One of the biggest challenges is managing billing and payments. From logging patient services to submitting claims and posting payments, there are a lot of steps.

Mistakes happen. Claims get denied. Staff spend hours chasing paperwork. Revenue cycle automation helps take the stress out of it. It can save time, reduce errors, and even improve cash flow.

What Revenue Cycle Automation Really Means

Revenue cycle automation isn’t just putting paper forms into a computer. It goes beyond simple digitization. Automation uses software, sometimes with AI or robotic process automation (RPA), to handle repetitive tasks. It keeps things accurate, consistent, and faster.

For small practices, that means staff can spend less time on admin and more time with patients. Some platforms even suggest corrections automatically, so fewer claims get rejected.

Core Pieces of Automation

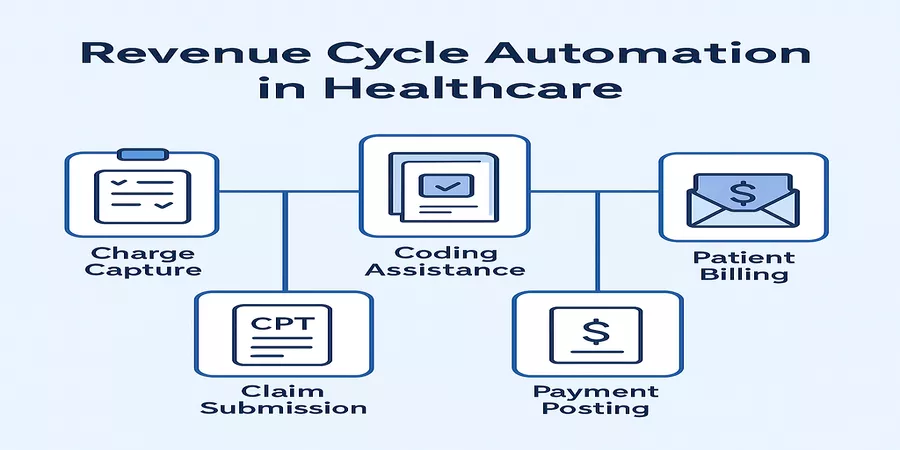

Most automated platforms cover all the key parts of billing:

- Charge Capture:Makes sure all patient services are recorded.

- Coding Assistance:Helps pick the right codes to avoid claim rejections.

- Claim Submission:Sends claims electronically using EDI standards.

- Payment Posting:Automatically applies payments to the correct accounts.

- Patient Billing:Creates statements and manages patient invoices efficiently.

All these pieces often come together in one platform. For example, management software for healthcare billing practices bundles these tools so practices and billing firms can handle the full revenue cycle in one place. It’s convenient, reduces mistakes, and makes reporting easier.

How Automation Works

RPA handles the repetitive stuff. It moves data, fills forms, and copies info between systems. AI helps catch errors. It can flag missing info, correct common mistakes, or suggest updates.

Together, they reduce rejected claims and save staff hours every week. Automation also relies on standards like EDI for electronic claims. That means it plays nice with insurance companies and clearinghouses. Compliance is built in too, so you’re following healthcare rules without extra work.

Why Small Practices Benefit

Small practices feel the impact quickly. Automation cuts billing errors and speeds up payments. Staff aren’t stuck chasing claims. Reporting becomes easier. Practices also notice better cash flow. And as the practice grows, scaling billing operations is much simpler. You don’t have to hire extra staff just to keep up.

Tips for Getting Started

Start small if you need to. Pick one part of the billing process to automate first, like claim submission or payment posting. Train your staff on the new system and get their feedback. Fix little issues as they come up. Once one module is running smoothly, add the next. Over time, your whole revenue cycle will become faster and more accurate without overwhelming anyone.

Managing the Change

Switching to automation takes planning. Staff need training. Workflows might need tweaking. Communicating clearly helps. Even small changes—like updating how coding reviews are done—can make a big difference. Some staff may resist at first, but showing them the time it saves usually wins them over.

Measuring Success

Keep an eye on things like how many claims get denied, how long it takes to get paid, and overall collections. Check these numbers regularly. It helps you see what’s working and what needs fixing. Over time, you’ll notice fewer mistakes, faster payments, and happier staff.

Using revenue cycle automation, practices can streamline billing, reduce errors, and keep cash flowing. It’s more than digitizing paperwork—it’s a smarter way to manage the business side of healthcare. Certain platforms make it easy to cover every step. Automation saves time, ensures compliance, and lets staff focus on patients instead of chasing claims. It can feel like a big change at first, but the benefits quickly become clear.